Examine This Report on Stonewell Bookkeeping

Wiki Article

The Single Strategy To Use For Stonewell Bookkeeping

Table of ContentsStonewell Bookkeeping - An OverviewThe Only Guide for Stonewell BookkeepingThe 8-Minute Rule for Stonewell BookkeepingWhat Does Stonewell Bookkeeping Mean?Rumored Buzz on Stonewell Bookkeeping

Rather than undergoing a filing cupboard of various files, billings, and invoices, you can present detailed records to your accountant. Subsequently, you and your accounting professional can conserve time. As an added reward, you might also have the ability to identify potential tax write-offs. After using your bookkeeping to file your taxes, the IRS might pick to perform an audit.

That funding can come in the type of owner's equity, gives, organization car loans, and capitalists. Yet, investors need to have a good idea of your business prior to investing. If you do not have accountancy records, capitalists can not establish the success or failing of your business. They need up-to-date, exact info. And, that info needs to be conveniently obtainable.

Not known Details About Stonewell Bookkeeping

This is not intended as lawful recommendations; for additional information, please click on this link..

We addressed, "well, in order to know how much you require to be paying, we need to know just how much you're making. What is your web income? "Well, I have $179,000 in my account, so I guess my internet income (revenues less costs) is $18K".

8 Simple Techniques For Stonewell Bookkeeping

While maybe that they have $18K in the account (and even that might not hold true), your balance in the bank does not always establish your earnings. If someone got a give or a car loan, those funds are ruled out revenue. And they would not infiltrate your income statement in determining your profits.

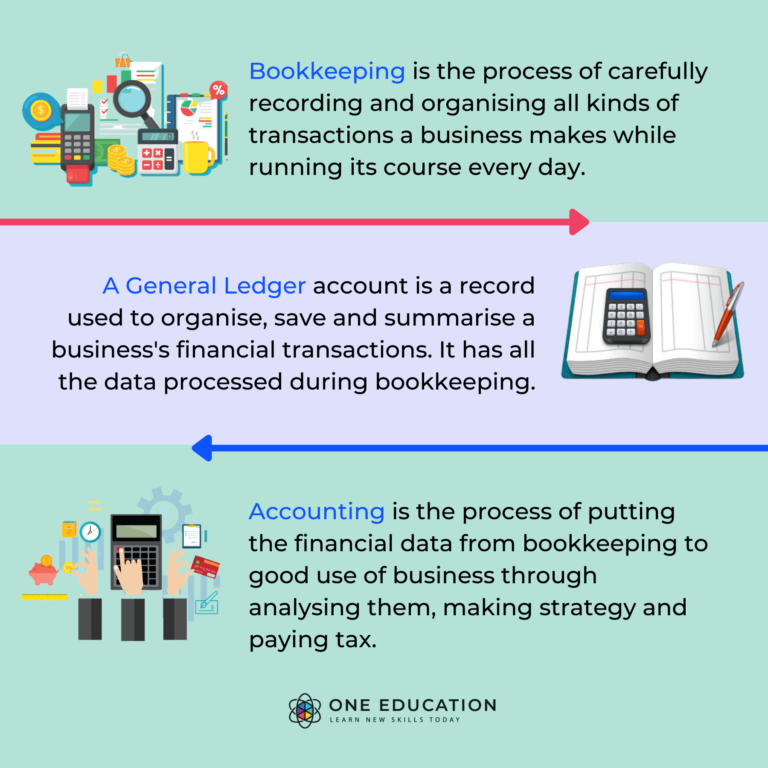

While maybe that they have $18K in the account (and even that might not hold true), your balance in the bank does not always establish your earnings. If someone got a give or a car loan, those funds are ruled out revenue. And they would not infiltrate your income statement in determining your profits.Numerous points that you assume are expenditures and reductions are in truth neither. Accounting is the procedure of recording, identifying, and arranging a business's monetary deals and tax filings.

A successful company calls for aid from experts. With reasonable objectives and a qualified accountant, you can conveniently address obstacles and keep those worries at bay. We dedicate our power to ensuring you have a strong financial foundation for growth.

What Does Stonewell Bookkeeping Do?

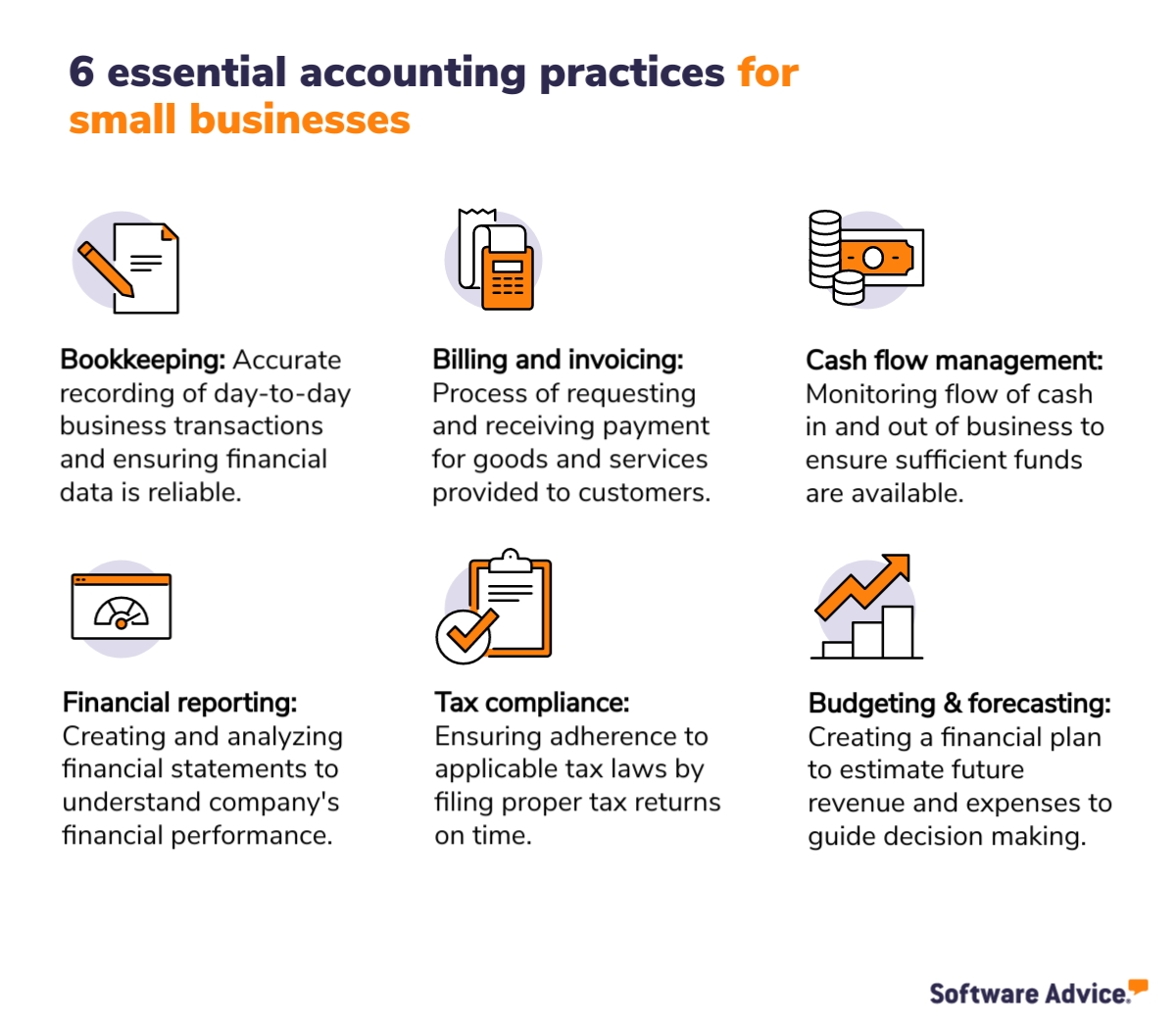

Exact bookkeeping is the foundation of excellent financial management in any company. It helps track revenue and expenses, making certain every deal is recorded properly. With excellent bookkeeping, organizations can make much better choices due to the fact that clear financial records offer beneficial data that can assist technique and boost profits. This details is key for long-term planning and forecasting.Accurate economic declarations construct trust with loan providers and financiers, raising your chances of getting the resources you require to expand., businesses need to on a regular basis resolve their accounts.

They guarantee on-time settlement of expenses and quick customer settlement of billings. This improves cash money circulation and assists to avoid late penalties. A bookkeeper will certainly cross financial institution statements with description interior records a minimum of when a month to discover mistakes or incongruities. Called financial institution settlement, this process assures that the financial documents of the firm match those of the financial institution.

Money Flow Statements Tracks money motion in and out of the organization. These records aid organization proprietors recognize their economic placement and make informed decisions.

Get This Report on Stonewell Bookkeeping

While this is cost-effective, it can be time-consuming and prone to mistakes. Devices like copyright, Xero, and FreshBooks enable company proprietors to automate bookkeeping jobs. These programs assist with invoicing, bank settlement, and monetary reporting.

Report this wiki page